Ireland has agreed to set a 15% corporate tax rate for large multinational companies.

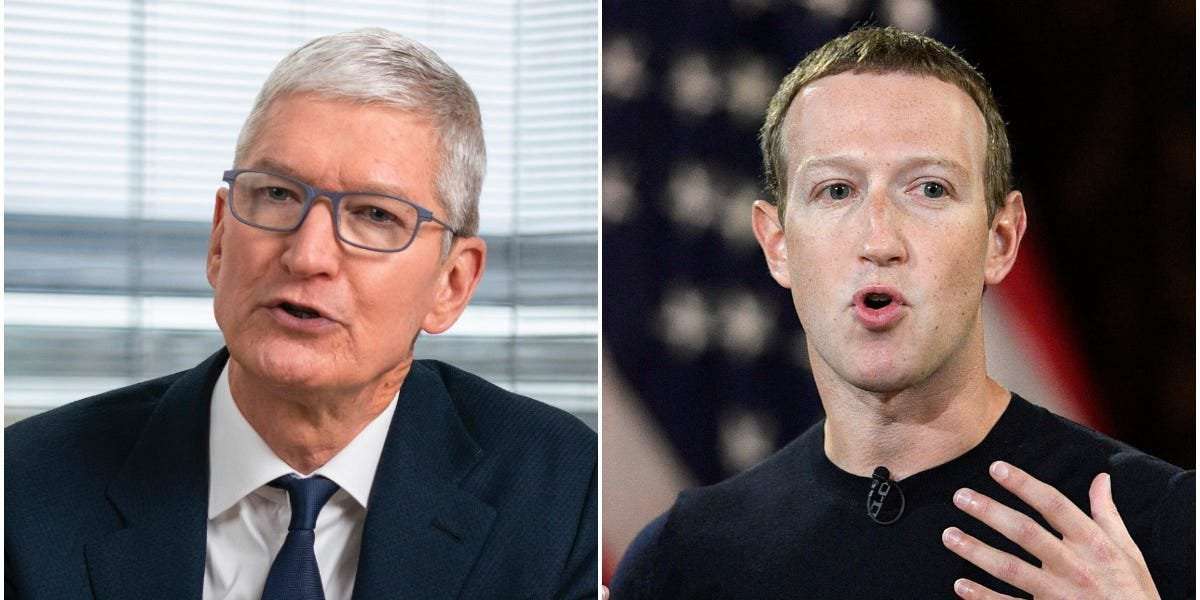

Ireland has been the low-tax European headquarters for tech giants including Apple, Google, and Facebook.

Ireland said on Thursday it would give up its 12.5% rate for large firms.

10 Things in Tech: Get the latest tech trends & innovations Loading Something is loading. Email address By clicking ‘Sign up’, you agree to receive marketing emails from Insider as well as other partner offers and accept our Terms of Service and Privacy Policy

Ireland said on Thursday it would join an international agreement to set a minimum corporate tax rate of 15%.

The country dropped its opposition to an overhaul of global corporate tax rules, agreeing to give up its 12.5% tax for large multinationals with revenues in excess of 750 million euros ($867 million).

Ireland, the low-tax European headquarters for tech giants including Apple, Google, and Facebook, declined to sign up to the initial deal in July, objecting to a proposed rate of "at least" 15%.

An updated text this week dropped the "at least," clearing the way for ministers to do what successive governments said they would never contemplate — giving up the low rate that has helped win Ireland investments and jobs for decades.

"Joining this agreement is an important decision for the next stage of Ireland's industrial policy - a decision that will ensure that Ireland is part of the solution," Finance Minister Paschal Donohoe told a news conference.

"This is a difficult and complex decision but I believe it is the right one."

All but a handful of the 140 countries involved signed up to the July deal, brokered by the Organisation for Economic Co-operation and Development (OECD), that marked the first rewriting of international tax rules in a generation.

The holdouts, which include fellow EU members Estonia and Hungary, can't block the proposed changes. The 140 negotiating countries are due to meet on Friday to finalise the deal.

The US Treasury, which had pressed Ireland to support the global minimum tax, hailed Dublin's decision as putting the world on a path toward a "generational achievement" to ensure corporations pay their fair share of taxes.

If Ireland had maintained its lower rate, multinationals that book profits there could be forced to pay the additional tax elsewhere under the proposals.

The government said it had received assurances from the European Commission that Ireland could maintain the 12.5% rate for firms with annual turnover below 750 million euros ($867 million) and keep tax incentives for research and development.

The Commission also promised it would stick faithfully to the OECD agreement and not seek a higher rate among member states, Donohoe said.

fattybumbs on October 8th, 2021 at 19:26 UTC »

It's not the corporate tax rate that is helping corporations to pay net 2 or 3 % tax on profits.

Its the IP and research taxes.

Until these loops are closed then corporations will still manage to pay less tax than what's advertised on the tin.

autotldr on October 8th, 2021 at 13:00 UTC »

This is the best tl;dr I could make, original reduced by 68%. (I'm a bot)

Extended Summary | FAQ | Feedback | Top keywords: tax#1 Ireland#2 rate#3 decision#4 agreement#5

Phyr8642 on October 8th, 2021 at 12:58 UTC »

In before corporations find a new tax haven. Shit, they probably already have a new one ready to go.