Pop stars Shakira, Elton John and Ringo Starr, German supermodel Claudia Schiffer, as well as Spanish singer Julio Iglesias are among the celebrities named in the Pandora Papers, a massive leak of private financial documents published by several news organizations over the weekend, which reportedly tie world leaders and the global elite to complex offshore accounting and tax-avoidance schemes.

Tax authorities in Australia and the U.K. have already confirmed they will analyze the trove of secret documents released by the International Consortium of Investigative Journalists (ICIJ) to see if there is any evidence that wealthy individuals named in the papers broke local tax law.

Alongside the billionaires and world leaders current and former named in the data dump of more than 11.9 million records — including former British Prime Minister Tony Blair, King Abdullah of Jordan and Czech Prime Minister Andrej Babis — the names of several celebrities turned up. ICIJ journalists allege that Shakira, Elton John, Ringo Starr and Claudia Schiffer all set up PO Box companies in known tax havens, such as the British Virgin Islands, Panama or the Bahamas, a setup often used to hide money from tax authorities. The news outlets that published the Pandora Papers revelations — a global consortium that includes The Washington Post, British newspaper The Guardian, Germany’s Sueddeutsche Zeitung and El Pais in Spain — do not accuse those names in the documents of having violated any laws.

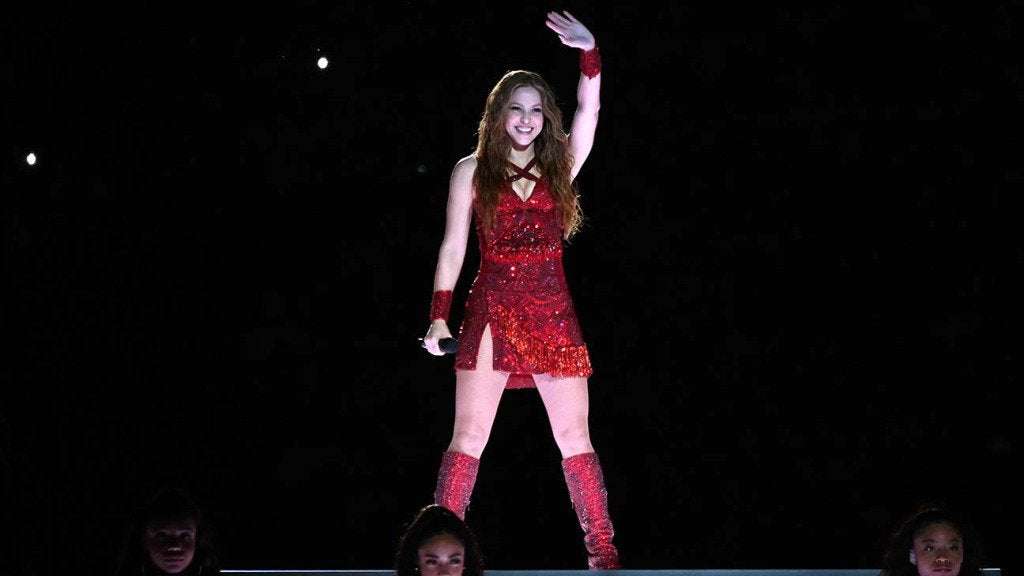

An attorney for Shakira told the ICIJ that the Colombian singer denies all wrongdoings, saying she had declared her companies in the Bahamas claiming they do not provide tax advantages. Representatives for Schiffer also claim the fashion star pays her taxes in the U.K., where she is based.

Shakira is facing a possible tax fraud case in Spain after a Spanish judge recommended in July that the singer face a trial over allegations she failed to pay €14.5 million ($16.84 million) in tax on income earned between 2012 and 2014. The case centers on allegations that Shakira lived in Spain during the period, although she was registered for tax purposes in the Bahamas. On Monday, Shakira’s lawyers said a Spanish court was likely to rule in favor of the singer, though court officials were not immediately available for comment.

The Pandora Papers are a follow-up to a similar project in 2016 from the same journalist collective called the Panama Papers. The Panama Papers, however, were based on a data leak from a single, now-defunct, law firm called Mossack Fonseca located in Panama. Some of the Panama Papers revelations were used as the basis of Steven Soderbergh’s Netflix satire The Laundromat, starring Gary Oldman and Antonio Banderas as Mossack Fonseca co-founders Jürgen Mossack and Ramón Fonseca.

The latest data dump is even larger than the Panama Papers and comes from documents leaked from some 14 different service providers doing business in 38 different jurisdictions worldwide. Some of the records date back to the 1970s, but most of the files are from 1996 to 2020.

On Monday, the U.K. chancellor, or finance minister, Rishi Sunak told Sky News the country’s tax authorities would review the leaked information and documents “to see if there is anything we can learn.”

Asked in a BBC radio interview if he was ashamed that London is sometimes seen as a place for rich people looking to get out of paying their fair share of taxes, Sunak, a member of the ruling Conservative Party, said: “I don’t think it is a source of shame because actually, our track record on this is very strong,” adding, “there is a global dimension to it, and we need other countries to co-operate with us to tackle this, but we are determined to do that.”

Political London also discussed the news from the leak that former Labour Party Prime Minister Tony Blair and wife Cherie avoided paying £312,000 ($423,000) in tax when they purchased a £6.45 million ($8.74 million) London townhouse in 2017 by buying the offshore company that owned it.

On the other side of the world, the Australia Tax Office said on Monday that it would also be analyzing the information in the Pandora Papers “to identify any possible Australian links.”

Georg Szalai contributed to this report.

OntarioIsPain on October 5th, 2021 at 01:07 UTC »

First she gets attacked by boars, and now is outed as a tax dodger.

It hasn't been a good month for Shakira.

boston_shua on October 4th, 2021 at 23:58 UTC »

Not a first for Shakira

https://www.forbes.com/sites/carlieporterfield/2021/07/29/shakira-could-face-trial-in-spain-over-tax-evasion-judge-rules/

Uddashin on October 4th, 2021 at 23:47 UTC »

The latest data dump is even larger than the Panama Papers and comes from documents leaked from some 14 different service providers doing business in 38 different jurisdictions worldwide. Some of the records date back to the 1970s, but most of the files are from 1996 to 2020.