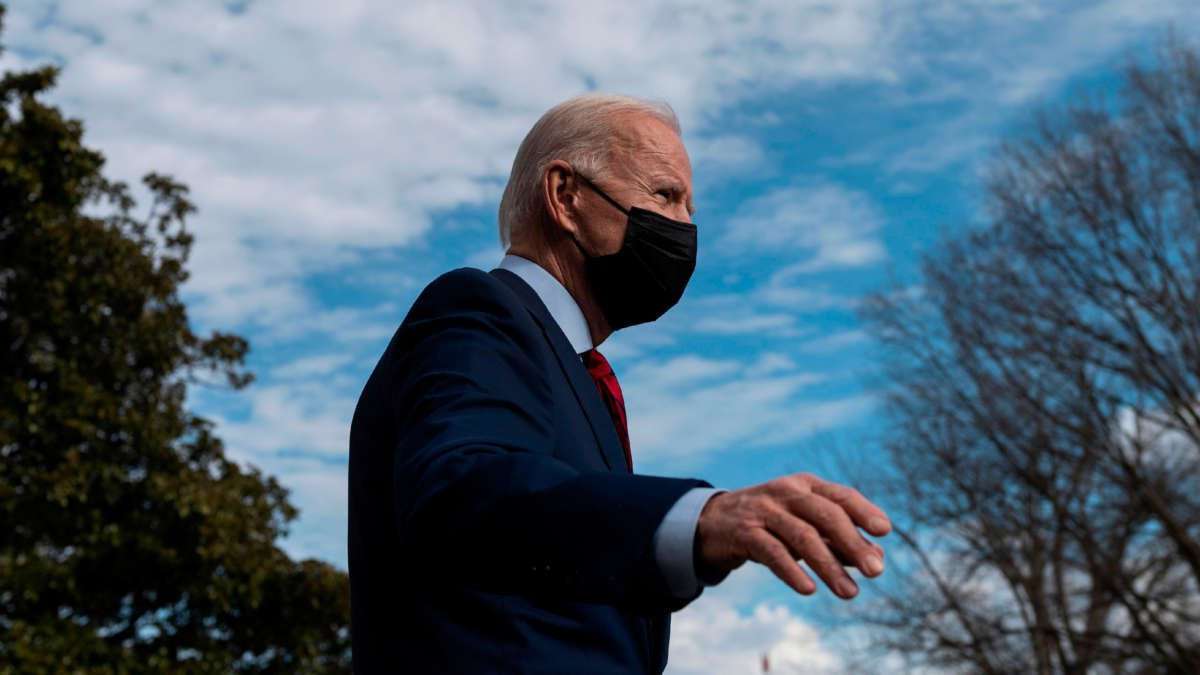

President Joe Biden is expected to push to raise taxes in the near future, primarily for corporations and for those earning higher incomes, in order to fund future high-spending priorities for the U.S.

Sources speaking to Bloomberg about the plan suggested that the overall proposal by Biden would be the first major increase in the tax code in the past 30 years.

The increases on taxes will be necessary in order to fund national infrastructure priorities and other projects that Biden intends to push for while in office. Proposals for generating revenue include raising the corporate tax rate to 28 percent (from its current level of 21 percent), increasing the estate tax, raising income taxes for those earning more than $400,000 annually, and setting up a tax on capital gains for individuals that make more than $1 million, among other ideas.

These measures would increase federal revenues by about $2.1 trillion, an independent analysis of the plan has noted.

The proposed corporate tax rate of 28% under Biden’s proposal would keep the rate lower than it was before former President Donald Trump’s tax cuts. In 2017, Trump reduced the corporate tax rate from 35 to 21 percent.

Former President Barack Obama also proposed a corporate tax rate of 28 percent along with closing many loopholes that allowed corporations to secure a much lower effective rate. At the time, Americans for Tax Fairness said Obama’s plan would have a “revenue-neutral” outcome. “The president has effectively accepted the Republican frame of the debate; he will accept cuts in numerous programs and services as long as taxes don’t increase on America’s most profitable corporations,” according to an analysis from the group.

Americans have been reticent in recent years to embrace such large increases in taxes. The president will aim to promote his plan by suggesting it is a way to make the tax code fairer.

“His whole outlook has always been that Americans believe tax policy needs to be fair, and he has viewed all of his policy options through that lens,” former Biden economic aide Sarah Bianchi said to Bloomberg. “That is why the focus is on addressing the unequal treatment between work and wealth.”

Raising taxes on the wealthy would fulfill a promise made by Biden to voters on the 2020 presidential campaign trail — and would be a policy that a majority of Americans could get behind.

Polling on the issue has consistently shown that raising taxes on wealthy incomes is a popular policy proposal. A January poll from The Hill/HarrisX found that nearly three-in-five Americans (59 percent) back raising taxes on all income over 10 million, for example, to a 70 percent rate. A New York Times/Survey Monkey poll published late last year, after Biden won the presidential race, also found tremendous support for raising taxes on incomes over $400,000, with 67 percent of voters saying they like that proposal as well.

Still, despite Americans’ strong backing for raising taxes on higher incomes, it will likely be difficult to enact such an agenda within Congress, as Republicans in the Senate will probably filibuster any plan to do so. GOP lawmakers and pundits will also likely attempt to disparage such proposals as being detrimental to the U.S. economy, or wrongly portray them as being directed to all income earners rather than just the wealthiest, as they have done in the past.

Biden has some political capital to work with, however, in order to push his agenda, if he wants to — recent polling from the Pew Research Center shows that the president currently has an approval rating of 54 percent among the general populace, with only 42 percent giving him negative marks regarding his work in office so far.

Copyright © Truthout. May not be reprinted without permission.

whileoceaniasleeps on March 16th, 2021 at 15:24 UTC »

“This is an outrage!” — Republican voters with popcorn ceilings, on $400k+ income tax increases

Ceratisa on March 16th, 2021 at 15:20 UTC »

Right wingers making less than 10% of what's needed to qualify for the tax hike are outraged

Astronom3r on March 16th, 2021 at 15:19 UTC »

If we keep voting for our own best interests, perhaps the ultra wealthy will actually end up being the ones paying for the enormous debt they've passed off to us plebs.