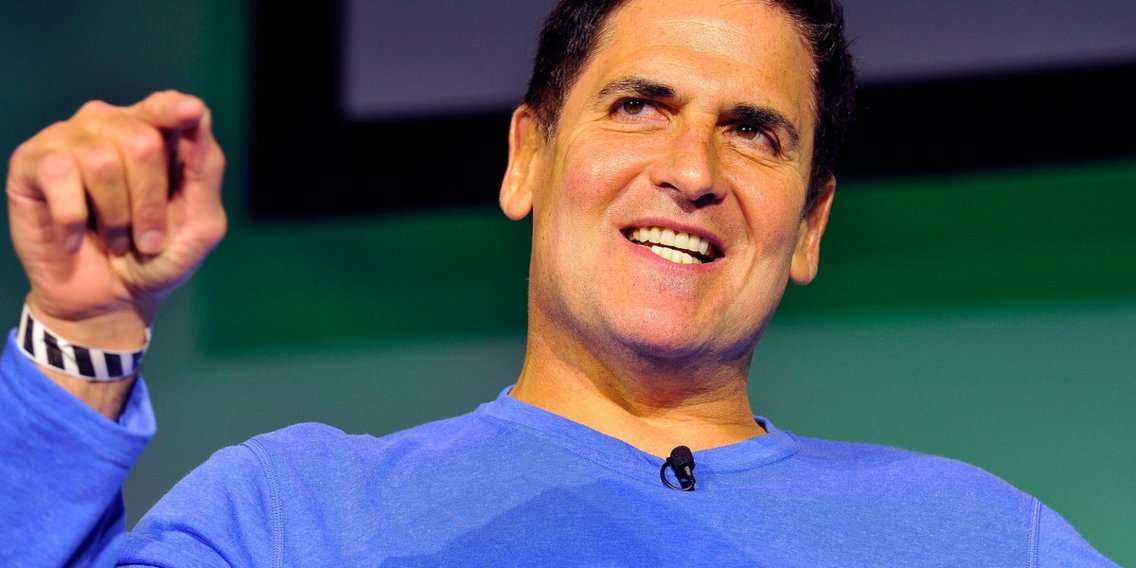

A financial technology startup that aims to help users avoid overdraft fees has raised more than $13 million in funding led by a number of investors including famed "Shark Tank" entrepreneur Mark Cuban.

Dave, which launched in April 2017 following a previous fundraising announcement, has been stealthily growing its user base.

The company's app alerts users when their checking account balance is on track to dip below zero based on upcoming expenses. It also provides users with small $75 loans to cover costs if they have a low balance. The point is to help folks avoid those dreaded $30-plus overdraft fees, which Cuban says plagued him during his college years.

Since April 2017, the company has grown quickly and revamped its app to support new features, including instant borrowing to help avoid overdrafts. That has partially been supported by the fundraise, which Cuban participated in alongside SV Angel, Section 32, and a number of other investors.

"Our team has grown from 8 people to 26 and our customer base is 25X in the last four or five months," Dave founder Jason Wilk told Business Insider in a recent conversation.

In total, the company has amassed more than 500,000 users since its last fundraise. Beyond overdraft fees, the point of Dave is to address the pain-points middle class folks face when banking with traditional financial-services firms, Wilk said.

"The banks continue to turn their back on the middle class audience," he said. "The banks are making it clear they only want wealthy customers."

Wilk noted that Bank of America Merrill Lynch started charging customers who don't keep a large enough balance in their checking accounts. And then there's overdraft fees. US customers paid more than $34 billion in fees to banks in 2017, the largest figure since the Great Recession, according to a report by the New York Post.

stewsters on June 23rd, 2018 at 18:03 UTC »

You can tell them to turn off overdraft protection. Your card will be declined instead.

Head on June 23rd, 2018 at 17:40 UTC »

Since nobody reads articles much around here the titles should be more descriptive. In this case "Mark Cuban invests in startup that aims to help people avoid overdraft fees".

CaptnCarl85 on June 23rd, 2018 at 16:26 UTC »

In Al Franken's "Why not me?" he runs a mock Presidential campaign on eliminating ATM fees. Is this that?