Billionaire investor and longtime Trump confidant Carl Icahn dumped $31.3 million of stock in a company heavily dependent on steel last week, just days before Trump announced plans to impose steep tariffs on steel imports.

In a little-noticed SEC filing submitted on February 22, 2018, Icahn disclosed that he systematically sold off nearly 1 million shares of Manitowoc Company Inc. Manitowoc is a “is a leading global manufacturer of cranes and lifting solutions” and, therefore, heavily dependent on steel to make its products.

The filing came just seven days before a White House event where Trump announced his intention to impose a 25 percent tariff on steel imports.

Trump’s announcement rattled the markets, with steel-dependent stocks hardest hit. Manitowoc stock plunged, losing about 6 percent of its value. Reuters attributed the drop to the fact that Manitowoc is a “major consumer of steel.” As of 10:20 a.m. Friday, the stock had lost an additional 6 percent, trading at $26.21.

Icahn was required to make the disclosure because of the large volume of his sale. The filing reveals that he began systematically selling the stock on February 12, when he was able to sell the stock for $32 to $34.

Commerce Secretary Wilbur Ross publicly released a report on February 16 calling for a 24 percent tariff. But, as the chart in the SEC filing indicates, Icahn started selling his Manitowoc stock on February 12, prior to the public release of that report. Moreover, the sharp drop in steel-related stocks did not occur until Trump announced he would accept the Commerce Department’s recommendations.

Before February, Icahn was not actively trading Manitowoc stock. According to regulatory filings, he did not buy or sell any shares of Manitowoc between January 17, 2015 and February 11, 2018. The February 22 filing was required because his ownership stake dropped below 5 percent. Now that he owns less than 5 percent of the company, he is not required to make another disclosure about his holdings until May. So while the latest filing shows him still retaining some stock in Manitowoc, Icahn could have continued selling the stock. If Manitowoc is not listed on the eventual May filing — called a Schedule 13F — that would mean he has liquidated all his holdings.

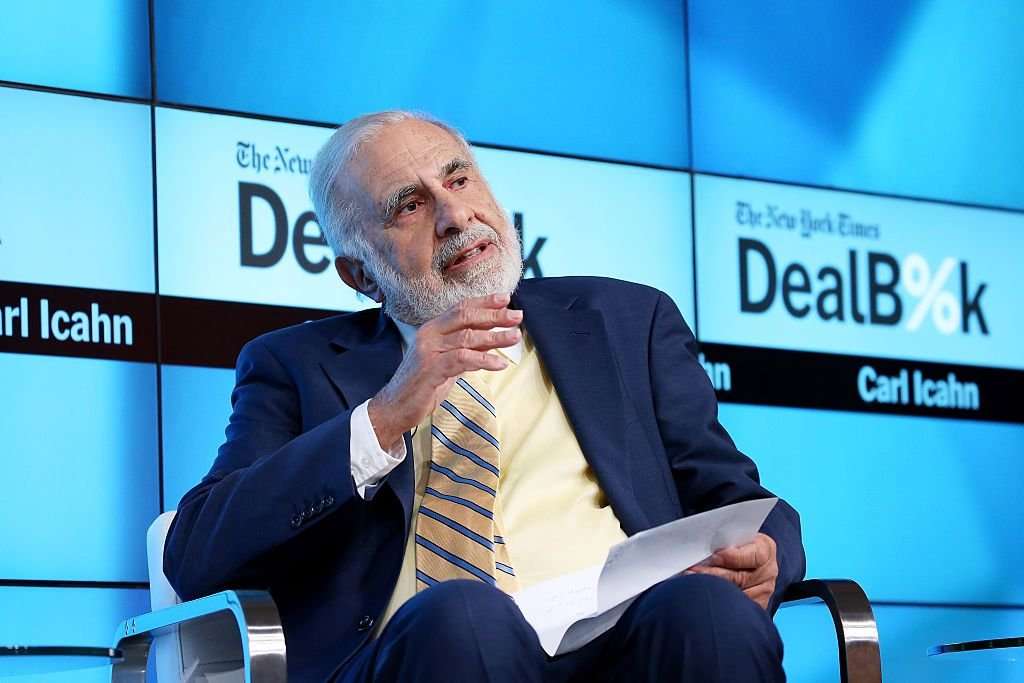

Icahn, a billionaire investor with far-flung holdings, is a close associate of Trump — who invoked Icahn’s name repeatedly on the campaign trail. Once in office, Trump installed Icahn as a “special adviser,” although Icahn did not not unwind his business entanglements before accepting the position.

Icahn resigned in August, in advance of a New Yorker article which detailed how he used his position in the White House and his connection to Trump to protect his investments:

One day in August, 2016, the financier Carl Icahn made an urgent phone call to the Environmental Protection Agency. Icahn is one of the richest men on Wall Street, and he has thrived, in no small measure, because of a capacity to intimidate. A Texas-based oil refiner in which he had a major stake was losing money because of an obscure environmental rule that Icahn regarded as unduly onerous. Icahn is a voluble critic of any government regulation that constrains his companies. So he wanted to speak with the person in charge of enforcing the policy: a senior official at the E.P.A. named Janet McCabe.

In his resignation letter, Icahn acknowledged discussing regulation of the refining industry with Trump, although he denied seeking to benefit any of his specific holdings. Icahn claimed that, despite being named an adviser, he “had no duties whatsoever.”

In an interview on CNBC on Thursday, Icahn appeared to acknowledge at least occasional ongoing conversations with Trump, saying the two had not had “much” interaction in the last four to five months.

The White House and a representative for Icahn did not immediately respond to request for comment.

This story has been updated with more information from regulatory filings.

otter111a on March 2nd, 2018 at 18:38 UTC »

Just trying to connect some dots here. We know real estate can be used to launder money largely due to the difficulties with determining a true value of a given piece of property.

So let's rack our brains for a moment here. How could Trump himself benefit from telling his buddy about the forthcoming steel tariff. Well...there'd have to be a property exchange between the 2 before the election that was way out of wack with the fair market price and then a second exchange after the presidency ends.

So let's say Trump basically gives Ichan a piece of property for pennies on the dollar. Ichan then needs only to develop that property to turn a profit. But that's not really helping Trump, right?

BUt let's say that unbalanced exchange of property represented a handing of a wad of cash over to Ichan. Then Trump helps Ichan make a profit elsewhere (steel sales) in exchange for this Ichan must later sell a property back to Trump for pennies on the dollar to hand Trump back his wad of cash.

So here's Trump handing Ichan a wad of cash to go make money with.

http://www.latimes.com/business/la-fi-trump-taj-mahal-20170509-story.html

Here's Ichan making a that property profitable again:

https://www.washingtonpost.com/politics/carl-icahn-donald-trump-business-rivalry-partnership/2016/04/30/4cc69316-024a-11e6-9d36-33d198ea26c5_story.html?utm_term=.ac0bbfb7a5be

All that's left is for Ichan to hand back the money with interest.

crv163 on March 2nd, 2018 at 17:29 UTC »

Mueller has all the tax returns.

Can’t wait to hear about them!

ETA: That article talks mostly about Manafort. Here’s one about Trump.

michael8684 on March 2nd, 2018 at 16:26 UTC »

It’s almost like he had some kind of ‘inside’ knowledge