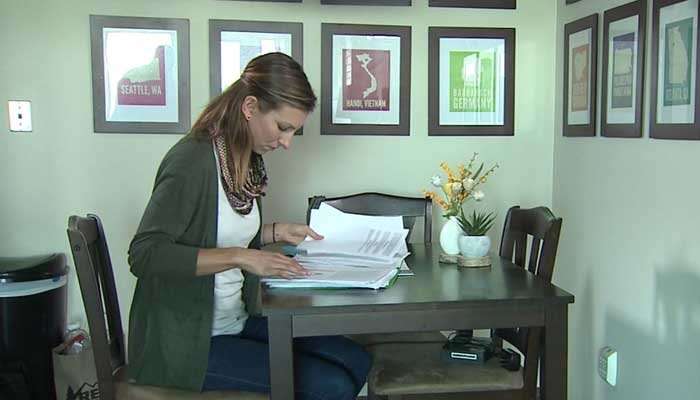

Katie Van Fleet said she is trying to get her life back together after her identity was stolen multiple times as a result of the Equifax breach. (Source: KCPQ/CNN)

SEATTLE (KCPQ/CNN) - Katie Van Fleet said she’s spent months trying to regain her stolen identity.

“I don’t know if my information’s been sold to the dark web or wherever this goes,” she said. “I keep receiving letters from Kohl’s, from Macy’s, from Old Navy saying, ‘Thank you for your application.’”

But she says she’s never applied for credit from any of those places. Instead, Van Fleet and her attorney believe her personal data was stolen during the massive Equifax security breach.

“It’s a product that they want to sell and that they need to profit off of,” said Van Fleet’s attorney, Catherine Fleming. “That’s what they care about.”

Fleming has filed a class-action lawsuit against Equifax, saying the company was negligent when it lost private information on more than 140 million Americans.

“Countless people. I mean, I’ve really, truly lost count, and the stories that like Katie’s, the stories I hear are heart-wrenching,” Fleming said.

“Everyone’s social has pretty much been stolen in the last 10 years,” said Cybersecurity expert Bryan Seely, who advises people to take steps to protect themselves from identity theft.

First, shop with a credit card. It’s easier to get stolen money back from a credit card than from a debit card.

Be sure to review your credit report regularly from all credit reporting agencies.

And, finally, he said you should freeze your credit. Doing so makes it impossible for strangers to open lines of credit in your name.

Van Fleet said she has spent countless hours trying to restore her good name, and she’s hoping to get a handle on the mess before she takes a crack at buying a house in Seattle.

“I didn’t sign up to use Equifax, so I feel all of that stuff has been taken, and now I am left here trying to sweep up the pieces and just trying to protect myself and protect my credit,” Van Fleet said.

People who want to freeze their credit should do so with all three major credit reporting agencies - Equifax, Experian and TransUnion.

Copyright 2017 KCPQ via CNN. All rights reserved.

butyourenice on October 29th, 2017 at 15:50 UTC »

That's the thing that gets me. This whole fiasco is infuriating, but the worst of it is nobody had any say in the matter. You can't opt out of credit-reporting. (And before somebody argues you can by being a complete hermit -- you have to go back to before you were born and make sure your birth is never registered so that you are not assigned an SSN, in order to never be tracked by the credit reporting agencies.)

poncewattle on October 29th, 2017 at 15:23 UTC »

Here's a scary thing that's happening with these Equifax stolen info. Fraudsters now are first calling up your credit card companies and changing your contact info using the info from that stolen data. Your address, contact info, email, etc. THEN they start running up the charges. So then when they call to check on suspicious charges, it doesn't reach you. And the bills don't reach you. And the collection notices don't reach you. It's not until it goes to a collection agency and they start hunting you down (like trying to attach your wages) that you find out something is amiss. By then the thieves have been going nuts with the accounts for several months. It's really bad if it's an account you don't normally charge things on and hence don't expect a bill on each month.

b12ftw on October 29th, 2017 at 13:33 UTC »

https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs