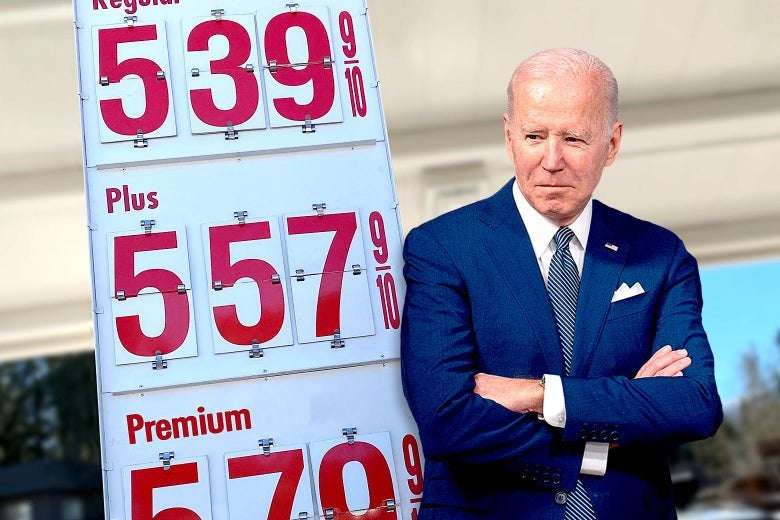

As gas prices have surged over the past several months—and shot up even further following Russia’s incursion into Ukraine—Republicans have predictably tried to pin blame on the White House.

“Joe Biden caused this and doesn’t seem to care,” the Republican National Committee’s deputy communications director tweeted last week, echoing the stickers that Trump-voting motorists have been slapping onto gas pumps across the country.

But President Joe Biden did not cause this. In fact, other than sanctions against Russia—which the GOP broadly supported—the primary reasons why filling up your tank has gotten more expensive over the past year have almost nothing to do with America’s chief executive. This shouldn’t be a surprise, since presidents almost never have much direct control over gas prices. But unfortunately voters act like they do, which is sort of the sad cosmic joke of American politics.

But I digress. Let’s debunk the argument, shall we?

Why Absolutely Nothing Republicans Are Saying About Gas Prices Makes Sense

Members of the GOP have been saying that a big reason the cost of gas soared over the past few months is that the president simply hasn’t let oil companies drill enough.

Specifically, they say, the White House has bottled up American fossil fuel production by issuing fewer oil leases on federal lands and by stopping pipeline construction.

For example: Republicans on the Senate Energy and Natural Resources Committee complained in a letter this month “there has not been one lease sale on federal lands since you imposed a ban in violation of federal law.” (They implored Biden to “take the shackles off American energy.”) And the House Republicans’ campaign chief blamed the gas price spike on the administration shutting down “drilling on federal lands,” “freezing all the permits” offered to oil drillers, and “killing the Keystone XL pipeline.”

It is true that U.S. oil production is lower now than it was in in February of 2020, when it hit an all-time record high of 12.8 million barrels. (That was before the market crashed at the onset of the coronavirus crisis.) But based on the GOP’s rhetoric, you might be tempted to think that U.S. oil production had collapsed since Biden stepped into the Oval Office.

That’s just not the case: In fact, oil production has actually increased, from about 11 million barrels per day to 11.5 million barrels through 2021. As Biden himself noted last week when announcing sanctions on Russian energy, domestic oil companies pumped more crude during the first year of his presidency than in the first year of Donald Trump’s. The number of oil rigs operating in the United States is still growing, too.

Indeed, much to the frustration of climate activists, Biden has actually done very little to slow fossil fuel production on federal property.

Biden did promise to halt new drilling on federal lands during his campaign. And in the first months of his term, he temporarily paused the sale of new public oil leases. But a federal judge struck down this pause in June, and then, in November, the Biden administration held the single largest-ever auction of oil and gas drilling leases from the Gulf of Mexico, locking in a future guarantee of more than 1 billion new barrels of oil from that region. (It’s worth noting that the administration was not required to make this sale, as the Justice Department itself admitted—it was entirely the government’s choice.)

The Biden administration also did pause sales again last month, after a Trump-appointed judge blocked the administration from considering climate costs when auctioning oil leases. So it’s a GOP-approved official who’s forced this halt on land sales while the administration rejiggers its energy accounting.

More to the point: Even if Biden had approved the Gulf of Mexico tracts earlier in his term, or leased more federal lands before the current pause, it wouldn’t have made much difference in today’s oil prices. It would have taken many months—in some cases, years—to extract, refine, and put those billion barrels on the market.

It’s also false to say the Keystone XL pipeline’s shutdown plays a role here. Last June, when Biden canceled an important permit for the Alberta-to-Nebraska crude pipeline, only 8 percent of the entire line had been constructed; the completed pipe wouldn’t have gone online until next year at the earliest. The Keystone talking point likewise ignores that the Biden administration allowed the controversial Line 3 pipeline in Minnesota to finish construction and go online in the fall, allowing for ongoing transports of Alberta crude. So there’s little reason for House Minority Leader Kevin McCarthy or South Dakota Gov. Kristi Noem to be so upset. We’re not suffering for crude imports from Canada, anyway, in large part because tens of millions of barrels travel into the U.S. by rail.

The Real Issue: Oil Companies Are Actually Just Trying to Pad Their Profits

The real reason U.S. oil production hasn’t returned to peak production levels has less to do with Biden’s energy policies than with the fossil fuel industry’s desire to earn a buck.

As demand for oil has resurged from its mid-2020 lows, producers have been under pressure from shareholders to “put profits over production increases” and “return cash to shareholders rather than pump it back into drilling,” to quote the Financial Times and Wall Street Journal, respectively. As a result, companies have only expanded production slowly.

Just listen to oil executives themselves. “Whether it’s $150 oil, $200 oil, or $100 oil, we’re not going to change our growth plans,” the CEO of Pioneer, which is the largest oil producer in the Permian Basin, the key oil-producing area of the Southwest, said at a Bloomberg event last month. “If the president wants us to grow, I just don’t think the industry can grow anyway.”

Occidental Petroleum CEO Vicki Hollub has likewise said her company is focused on paying back investors at the moment: “I feel now that we do need to return cash to the shareholders in the form of dividends or buybacks, especially during the better cycles.”

Profit motives have held back oil production outside the U.S. too. OPEC countries hard hit from the recession kept a tight cap on output last fall—despite pressure from the U.S. and Japan and India to pump more—in order to goose their revenues. They only began to relent last week, when the United Arab Emirates announced it would increase production, leading prices to retreat a bit. As oil historian Gregory Brew told me last month, the UAE does have spare oil capacity at hand—and it doesn’t want continued high prices to potentially suppress global demand.

Energy companies and oil-rich Middle Eastern monarchies aren’t the only ones cashing in. An L.A. Times report notes that some of the California gas stations that were charging $7 per gallon were setting their prices far above state and national averages because they found that desperate drivers were willing to pay—even if it hurts.

Why All This Actually Sort of Matters

Aside from political points scoring, why does any of this matter? Well, it has implications for a policy debate that’s unfolding in Washington.

At the moment, the Biden administration is looking to secure new sources of oil to offset the loss of Russian crude, and has been talking to Iran and Venezuela about increasing production in return for reducing sanctions on those countries. But this move has triggered a bipartisan backlash from foreign policy hawks, who don’t want the U.S. doing business with either of those nations. Republicans have introduced a bill to ban the U.S. from purchasing oil from those countries, and have argued that Biden should be focused on increasing U.S. production instead.

RT if you agree → Biden should be turning to AMERICAN energy producers for more oil and gas—not dictators in Venezuela, Iran, and Saudi Arabia. — Steve Scalise (@SteveScalise) March 7, 2022

This position only makes sense if you think the Biden administration is holding the U.S. oil industry back. But the TL;DR here is that it is not Biden—it’s the drillers themselves who are holding it back.

Oil prices have come down quite a bit in recent days thanks to various global developments, but they are still hovering above $100 a barrel. Unless our government is willing to do business with some unsavory regimes, American drivers are probably going to keep feeling pain at the pump.

But as long as they’re blaming Biden, Republicans will probably be just fine with that.

Edea-VIII on March 19th, 2022 at 13:52 UTC »

Am I the only one that remembers the complaint that low gas prices during the Obama administration were "bad" for the economy?

MagicSPA on March 19th, 2022 at 13:26 UTC »

Back when gas prices were high in the GWB era, staunch Republicans I argued politics with online defended it, saying that high gas prices were good for certain investment portfolios, and would incentivise finding ways to become less dependent on foreign oil.

I wonder how those same guys would spin high gas prices now...hmm...

HyperApples on March 19th, 2022 at 13:25 UTC »

So it's Biden's fault fuel is so expensive in Australia, and the UK, and New Zealand, and Japan, and Kazakhstan and...