President Joe Biden’s ambitious social spending and climate-change package of legislation, the Build Back Better Act, appears unlikely to pass as originally written after the moderate West Virginia Democrat Sen. Joe Manchin declared his opposition in the days before Christmas and reiterated this week that there are no ongoing discussions over the bill.

Though it’s possible Democrats can muster their razor-thin margins in the House of Representatives and Senate to pass some sort of stripped-down spending bill, it’s almost a certainty that Biden will either this year or after a likely loss of the House after the November elections, turn to regulatory changes as the primary vehicle for his policy vision.

“While Biden will seek to bring some version of his Build Back Better legislative agenda to fruition, he will look to motivate his party’s base heading into the midterm elections with wins that don’t require any congressional action,” wrote analysts at Beacon Policy Advisors, in a note to clients this week.

The Biden administration has not shied from using executive authority to implement his economic agenda. For instance, it has raised the minimum wage for federal contractors to $15 per hour, while federal agencies ranging from the Federal Trade Commission to the Department of Agriculture are engaging in an administration-wide review of antitrust policy.

But there are few other policies that could motivate Biden’s base more than student loan forgiveness, given that voters with college degrees support Biden as president in much greater numbers than voters without degrees.

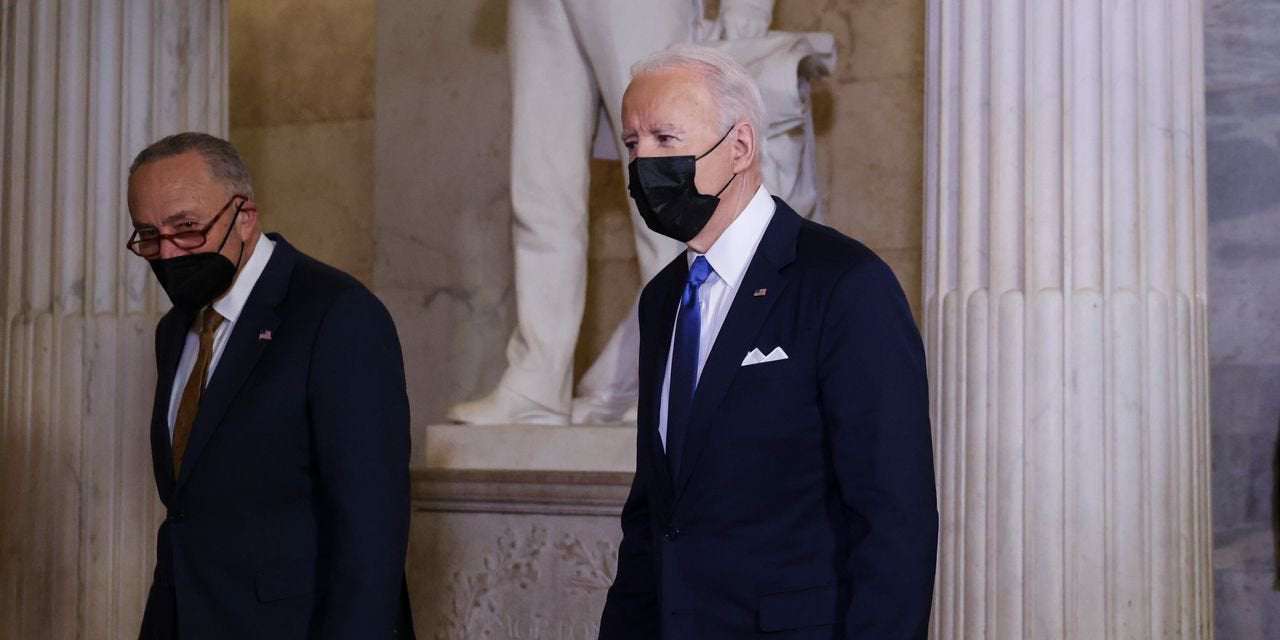

Senate Majority Leader Chuck Schumer, the New York Democrat, has consistently urged Biden to use executive authority to forgive up to $50,000 per student in federally backed student loan debt, a move that would add $1 trillion to the budget deficit in the long run, according to the Brookings Institution. (It would not add to the national debt, however, because debt was already issued in order to create the loans in the first place.)

Biden has said he doesn’t believe he has the legal authority to forgive student loans by fiat, and has said he would prefer that Congress authorize the forgiveness of $10,000 in debt per student. Earlier this year, White House officials said they were reviewing Biden’s legal authority to cancel student debt through executive action.

Legal experts say there is no clear answer as to whether the president has the authority to cancel student loan. Opponents of the policy say that it would violate the Appropriations Clause of the Constitution and the 1982 Antideficiency Act, which prohibits the executive from spending money without the authority of Congress.

Proponents of the policy say that these provisions don’t apply to student loan forgiveness, as Congress authorized the spending and federal law gives the Secretary of Education wide authority to decide how and whether to collect debt repayments.

“Everybody agrees that the Secretary of Education is empowered to make adjustments on federal student loans,” wrote Howell Jackson, a Harvard University law professor in an April article in the Regulatory Review. “The debate turns on the precise meaning of provisions of the Higher Education Act of 1965 which confer upon the Secretary the power to ‘consent to modification’ of, and to ‘compromise, waive, or release,’ amounts due on certain student loans.”

When Biden and House Speaker Nancy Pelosi, a California Democrat, say they don’t believe the president has the legal authority to cancel student debt, they are referring to interpretations of the HEA and other relevant laws. But a more important question, according to some advocates of the policy, is whether there would be any recourse for opponents of the policy to stop the president were he to pursue it.

“Lawsuits challenging administrative student debt would likely fail,” according to a recent memo issued by Massachusetts Democratic Sen. Elizabeth Warren, adding that it would be difficult for any person or state to prove that they have been wronged by the policy, a necessary step for plaintiffs to achieve standing in federal court.

Jackson argued in a Harvard Law School briefing paper that companies the federal government hires to service federal student loans could likely receive standing if they desired to sue the government. He noted that the federal government was set to pay student loan servicers about $1.1 billion last year, and the loss of such revenue could motivate those companies to sue to block forgiveness.

The Warren memo, however, argued that it’s unlikely courts would remedy these companies’ losses by blocking forgiveness altogether. “Even if a person or entity could successfully argue that they have standing, they were somehow

wronged, and that they are owed some legal remedy — no person or entity could reasonably argue that the remedy to their lawsuit should be indefinitely keeping tens of millions of student loan borrowers in debt,” it reads.

Even if political considerations take precedence over the law, it’s not clear that the Biden administration will enact student loan forgiveness by fiat, according to Beacon research analyst Charlotte Jenkins.

“Biden has expressed skepticism about blanket forgiveness allowing students who attended elite institutions to have relief and is likely fearing backlash from angry voters who have already paid off their own student loans or who did not choose to pursue higher education due to its cost,” she wrote in a Friday note to clients.

“Exacerbating this dilemma is that through executive action it is more difficult to implement the means-tested forgiveness that could make forgiveness more palatable to moderates and the millions of blue-collar workers Biden uses as a litmus test for presidential action,” Jenkins said.

“The looming midterm elections will keep deferment and forgiveness on the agenda as the Democratic Party debates the political consequences of each outcome,” wrote Jenkins.

Piperplays on January 8th, 2022 at 17:48 UTC »

I remember President Bush starting trillion dollar wars that weren’t approved by Congress; comparatively, why are Democratic Presidents so scared of bending the rules like their conservative opponents?

bussard_collector on January 8th, 2022 at 17:29 UTC »

Cancel Student Loan Debt. Lower the age of Medicare to 55 and open it up to anyone making less than 30k. Legalize marijuana. The Democrats will keep the house

Raspberry-Famous on January 8th, 2022 at 16:16 UTC »

Democrats get in and decide they're going to be "fiscally responsible" on the backs of working people, they get voted out and get replaced with Republicans who are spendthrifts with all of the benefits going to the super rich. Rinse and repeat for the last 45 years.

It's almost like our whole political system is basically a scam.