HuffPost is part of Verizon Media. We and our partners will store and/or access information on your device through the use of cookies and similar technologies, to display personalised ads and content, for ad and content measurement, audience insights and product development.

Your personal data that may be used

Information about your device and internet connection, including your IP address

Browsing and search activity while using Verizon Media websites and apps

Find out more about how we use your information in our Privacy Policy and Cookie Policy.

To enable Verizon Media and our partners to process your personal data select 'I agree', or select 'Manage settings' for more information and to manage your choices. You can change your choices at any time by visiting Your Privacy Controls.

Rtillies on February 3rd, 2021 at 06:44 UTC »

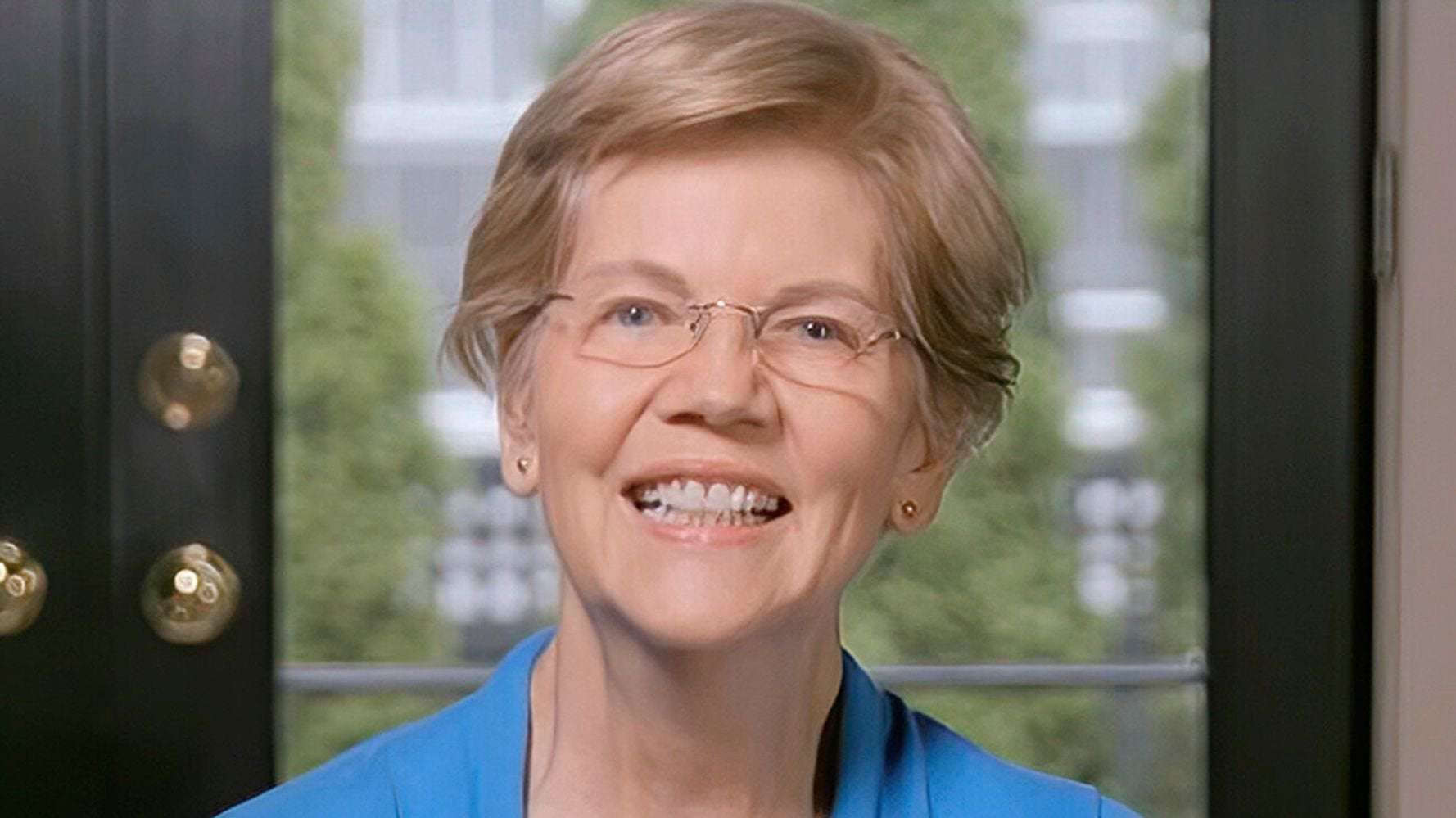

Elizabeth Warren literally created the financial protection bureau that saves us from predatory interest rates. She has an amazing resumes and it’s actually positive to see people who have these perfect resumes their job instead of rich friends. I think the concept of letting the monkey take the wheel died and now we’re back to having people with degrees take positions.

KapahuluBiz on February 3rd, 2021 at 04:14 UTC »

For those who are interested, check out this piece in the New York Times entitled The Rich Really Do Pay Lower Taxes than You

In 1950, the wealthiest 400 people in the country paid a combined 70% in State, Federal and Local taxes. Over the next 15 years, it stayed above 50%, and during that time, our country experienced tremendous prosperity and growth. However, over the next several decades, the amount paid by the wealthiest 400 Americans kept dropping.

Fast forward to 2018, when for the first time ever, thanks to Trump's tax cuts, the 400 wealthiest families in America paid a lower combined tax rate than every single other group - even compared to the poorest 10%. I was skeptical of these numbers, so I read the source: a book called The Triumph of Injustice by two well respected economists from UC-Berkeley. Their methodology is sound.

Even if we created a new tax policy that placed a much larger portion of the tax burden on the highest income earners, it won't fix the problems with wealth inequality. The decades of terrible tax policy have already tilted the playing field too heavily in favor of the ultra-wealthy.

I'm a CPA, and when I discuss tax policy with my clients, I try my best to stay neutral, but one thing that has amused me are the number of clients who seem to be really bothered by the thought of a wealth tax. Even after I explain how it's calculated, some of them get enraged! "It's MY money! I earned it and paid taxes on it already! The government can't just swoop in and demand a piece of it! It's MINE!" The whole time, I'm thinking to myself, "I know how much you earn and I have a pretty good idea of how much in assets you own. You'll never be worth $50 million, so chill out."

UGA10 on February 3rd, 2021 at 03:24 UTC »

Maybe it's because I don't have $50,000,000, but if I did have that much money, paying a 2% tax wouldn't be the end of the world to me...