While the pandemic has caused unrelenting and blistering damage in every segment of our economy, the pain is simply not distributed equally. Many of our essential workers are in the least secure jobs, with weak healthcare support, low wages, and ultimately are in jobs that keep them financially stuck while risking their health. What is troubling about this scenario is that we are seeing crony capitalism rearing its ugly head yet again – with the large bailouts we still do not have a clear picture as to where trillions of dollars went and we are devaluing actual work to support opaque networks of money. We do know that Millennials and younger Americans are getting pummeled once again in this crisis. Millennials shoulder a disproportionate amount of the more than $1.6 trillion in student debt, have lower home ownership rates than previous generations, and are also taking a big brunt of the job losses from this pandemic. Millennials never recovered from the Great Recession and this economic contraction is hitting them even harder.

Americans build wealth through real estate for the most part. This is largely accomplished through buying a home. Most don’t view their home as an investment but in large part a home is a forced savings account. Just like compound interest, continually paying a mortgage overtime will build equity and ideally after 30-years, you will have a paid off home. The problem is that Millennials were lagging in this respect because of the Great Recession but are now going to be hit harder in this Covid-19 crisis:

This chart is rather startling. It shows how far behind Millennials are from Baby Boomers and Gen X in terms of building up real estate wealth. It is hard to see how this will change any time soon. Part of this has to do with massive debt from student loans but also because of lower wages from the current economy. While Millennials were making some recent headway, that has reversed with this crisis:

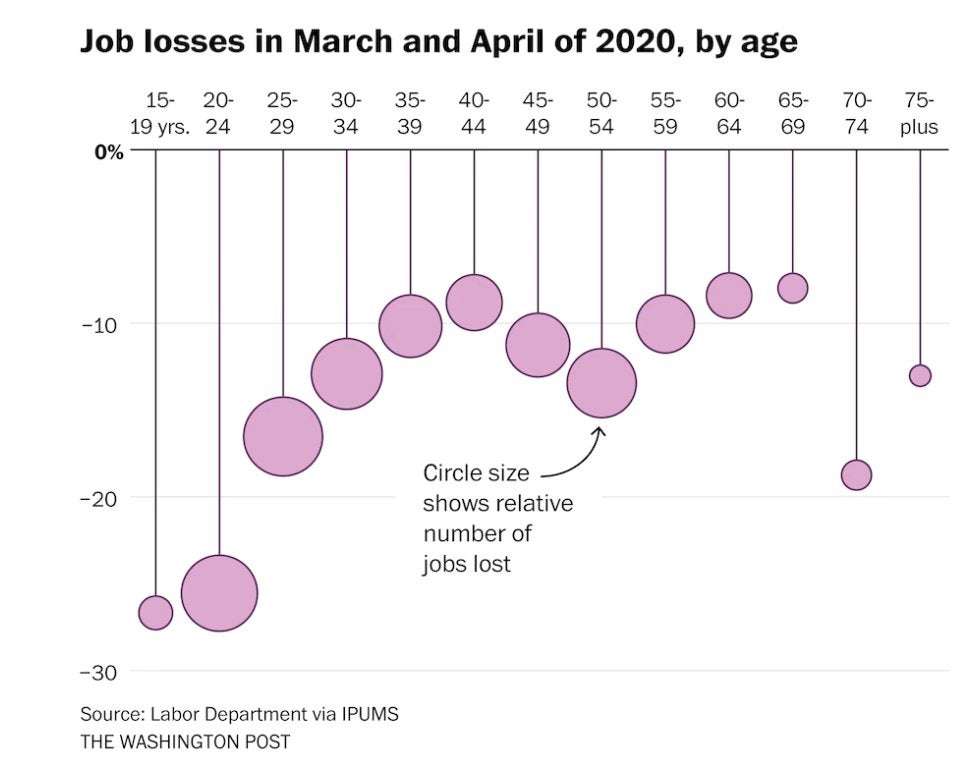

Many jobs simply evaporated with the pandemic. The chart above highlights the larger burden on younger workers. Many of the jobs lost were held by younger Americans. Obviously those without work are unlikely to buy a home and start the slow process of building equity. And how bad is the economy right now?

30.55 million Americans are officially getting paid unemployment insurance. Our true unemployment rate is upwards of 20 percent which is inching closer to Great Depression levels. It is hard to believe that just in March, our economy was near record low unemployment. However, this number was deceptive since many younger Americans were already living paycheck to paycheck and were barely making it. This pandemic has accelerated the reckoning that many were going to face in say 3 to 5 years and has pulled it into 2020.

It is hard for a cohort to feel that their generation is simply going to have it economically worse than their predecessor, especially in the US. Not that this is a hard and fast rule and we have plenty of cases throughout history where stable and good economies suddenly edge lower. Yet the issue with what is happening right now is that we are back to crony capitalism in that we are bailing out those that least need it and simply sacrificing the poor and younger generations to keep the machinery going. We devalue earned income and over glorify investment income even though as a percentage, very few younger Americans have money in investments. In fact, most Americans do not own a significant portion of stocks:

Half of Americans own no stocks. Another 35.4 percent own stock indirectly through retirement accounts (most are through work which of course is tough to save for retirement when you are not working), and finally 13.9 percent directly own stocks. Which then leads into the reality that the top 10 percent of US households own 70 percent of all outstanding wealth:

If this pandemic continues to cause economic damage in this format, Millennials may find themselves in a race where they are unable to catch up past generations economically.

pcar773 on June 29th, 2020 at 13:55 UTC »

Technically, my 15 shares in my Robinhood account mean I own stock, but this is after losing $500 on a different 15 shares of shitty stock.

NewCenturyNarratives on June 29th, 2020 at 13:29 UTC »

I really feel for my friends that are still working in the service industry. I worked in cafes for almost 10 years, and by the time you've fed yourself and paid rent, there isn't anything left. There really seems to be no hope for any kind of relief.

forever_a10ne on June 29th, 2020 at 11:55 UTC »

That pie chart is kind of shocking. Do 50% of Americans have no 401k/stocks or is that 50% of millennials? Either way, that’s no good.